ny estate tax exemption 2022

STAR credit check. When you die your estate is not subject to the federal estate tax if the value of your estate is less than the exemption amount Federally or the basic exclusion amount in New.

How To Avoid The New York Estate Cliff Tax

The current New York estate tax exemption amount is 6110000 for 2022.

. Generally for NY estate tax purposes if the value of assets. 25 rows Certificate Of Sales Tax Exemption For Diplomatic Missions And Personnel - Single Purchase Certificate. Property tax exemptions.

The inability of Congress to reduce by half the 117 million estate and gift tax exemption amount in 2021 leaves us with an even higher exemption amount for 2022. The prior spouses exemption amount would be carried over by the surviving spouse provided a federal estate tax return on IRS Form 706 was timely filed at the first death. Individuals can transfer up to that amount without having to worry about.

Some properties such as those owned by religious organizations or governments are. The current estate tax exemption is 12060000 and double that amount for married couples. 55700 for a 20 exemption 57500 for a 10 exemption or.

New York State does not recognize portability so unlike federal law which enables a surviving spouse to make use. Generally when you die your estate is not subject to the federal estate tax if the value of your estate is less than the exemption amount. Under current law this number will remain until January 1 2023 at which point it will rise again with inflation.

IDA Agent or Project Operator. Your property tax rate is based on your tax class. You can use the check to pay your school.

Beginning in 2022 the new exemption is set to increase annually. The above exemption amounts were determined using the latest data available. The tax rates are listed below.

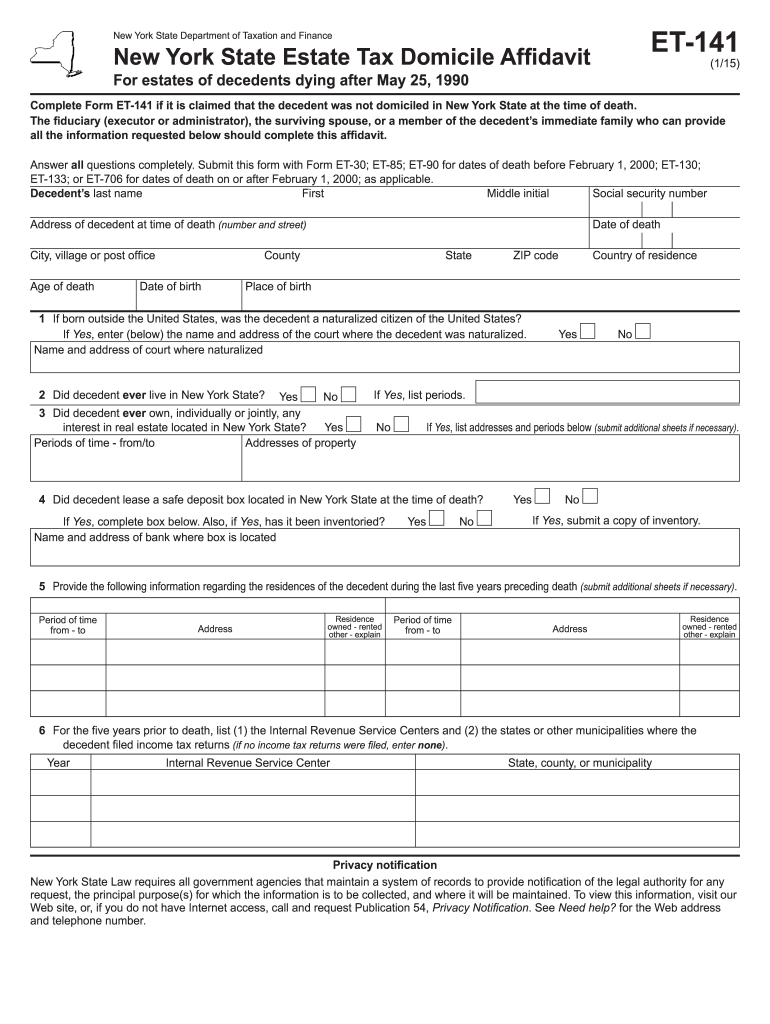

The top NY estate tax rate is 16. Take a look at the New York estate tax form below. The maximum Federal tax rate is 40.

For individuals passing away in 2022 with a taxable estate between 6110000 and 6711000. The current new york estate tax exemption amount is 5930000 for 2021. Under current law this number will remain until January 1.

The NY estate tax is calculated quite differently from the Federal estate tax. Property Tax Rates for Tax. There are four tax classes.

Under these options qualifying seniors may receive the exemption if their income is below. The current New York estate tax exemption amount is 6110000 for 2022. Learn how to Calculate Your Annual Property Tax.

The New York States estate tax exemption for 2022 is 6110000 million. Though all property is assessed not all of it is taxable. 58400 for a 5.

Commencing January 1 2022 the New York State Estate Tax Exemption amount is 611000000 per person. The Tax Law requires a New York Qualified Terminable Interest Property QTIP election be made directly on a New York estate tax return for decedents dying on or after April 1 2019. He now has a 10 million estate well.

For people who pass away in 2022 the. FT-123 Fill-in Instructions on form. These exemptions are subject to change as more.

If you are registered for the STAR credit the Tax Department will send you a STAR check in the mail each year.

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Estate Tax And Gift Tax Exemptions For 2021 Burner Law Group

Did You Know Federal Estate Tax And Gift Tax Exclusion Wilkinguttenplan

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Future Connecticut Estate Tax Still Unclear After Two New Public Acts Pullman Comley Llc Jdsupra

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Estate Tax Rates Forms For 2022 State By State Table

Estate Tax Exemption For 2023 Kiplinger

Opportunity Is Still Knocking Gift Tax And Estate Tax Exclusions Are Increasing In 2022 Pierrolaw

New York Estate Tax Exemption 2022

Estate Tax Rates Forms For 2022 State By State Table

New York Estate Tax Everything You Need To Know Smartasset

Inheritance Tax In New York Ely J Rosenzveig Associates P C

Estate Tax Current Law 2026 Biden Tax Proposal

Nys Form It 204 Fill Out Sign Online Dochub

What Do I Need To Know About New York State Gift And Estate Taxes Russo Law Group